AWARENESS BLOG

The purpose of these short blog articles is to increase awareness of one’s own perceptions in different finance-related contexts. Nothing in this blog or website represents an advertisement, advice, a recommendation, request, offer or invitation for an offer to buy or sell products.

Jorginho, Kane, decisions and risk

Even if we never shot a penalty in a Euro-cup final, we can try to imagine how tough it must be psychologically. Jorginho against Spain may have given us the illusion that it is easy – this impression was then reversed in the final against England. Good for Italy how it all ended up despite that. The Approaches The penalty takers are confronted with a binary outcome (score or fail) and a binary decision: “Kane-type” of kick: the player kicks without trying to anticipate the goalkeeper’s...

“Meme stocks” and biases

In the last months we have been strongly exposed through the media to the so-called “meme stocks” and to the, at least assumed, fight between retail traders and professional short sellers like hedge funds. Apart from the social and ethical aspects that have been debated with regards to short selling and short squeezing, which are very interesting, it is also interesting to reflect on the influence that the media coverage on meme stocks can have on our investment decisions. The exposure mostly...

Is the VIX saying “back to normal”?

Last week the most popular volatility index, the VIX, went briefly below 15% for the first time since the 20th February 2020, before the spike in volatility triggered by the fears of the pandemic. Broader equity market indices, like the S&P 500 and the EuroStoxx are above (significantly above in the case of the S&P 500) their pre-pandemic-peak levels. Since we humans are very prone to look for and see patterns, even when there are none, I won’t compare the pattern since 2020 to those...

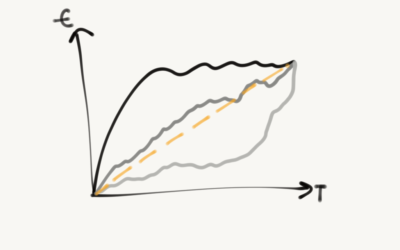

The «Since Inception» Performance Temptation

As I was writing another post on Private Equity (here), and one of the papers mentioned in the post (Phalippou, 2020) was highlighting the issues of “since-inception IRRs” of old Private Equity firms, thought it was worth touching on that issue separately. This post is mostly a warning for the general public about advertised long-term IRRs, not only in the PE space, but applied to any investment product. One long-term performance number does not mean much, sometimes it doesn’t even mean...

Redistribution of wealth … the other way round

Each fund manager a compelling story and a compelling experience, set of skills and/or track-record to boast. Some years or decades ago, hedge funds were the most popular ones deserving the highest fees, in the last years they have been in decline in terms of popularity, replaced by private equity, with its hefty management fees and carried interest (performance fees) calculated generally against a hurdle rate. Listed equity funds can command high fees, too, mostly relative to a fixed hurdle...

Tax imperialism, fairness, or “historic” farce?

Already at the end of March the U.S. was reported considering a global minimum tax rate. If your national debt is going out of control and are at risk of losing competitiveness, well, it makes sense egoistically to try and make other countries less competitive, less attractive. At the same time, the “race to the bottom” in terms of corporate tax rates, which the U.S. declared a fight against, sounds sensible, especially when national debts are massively on the rise after Covid. In theory, it...

Cryptos, environment and big picture

The China crackdown on cryptocurrencies, ranging from mining to trading, from payments to investment products, covering most of the value chain, was seen in the West (at least this is my impression) mostly as a speculative headline. Just to cite two sources see this summary by Reuters and another article by the South China Morning Post. What I find interesting is that while China may have taken a somewhat aggressive and cohercive stance, it at least seems to have sent a strong message to...

IPO: no cows involved

Last week the oat milk company Oatly went public, pricing the IPO at a level yielding a market cap of ca 10bn dollars, then rising in the first few days quite a bit above that. In line with this post on IPOs and underlying company profitability, the IPO was very successful while the company is still unprofitable.But what I wanted to reflect on is the following: in July 2020 Oatly announced an investment in its shares of 200m dollars by private equity and celebrity investors valuing the company...

Lessons from the Eurovision music contest

This weekend the annual Eurovision contest took place, with one singer/group from various European (in a broad sense) countries competing. Italy won, followed by France and then Switzerland third. For those who don't follow it (and I have to admin this was the first time for me) the Eurovision final scoring works with a combination of national jury votes and televote. Let's put it this way: the national jury is the "institutional" vote, and the televote is the "retail/popular" vote. First runs...

Cryptos and the (rewritten) Dutch Tulipmania

The cryptocurrency market trajectory is sometimes compared to the Dutch Tulip Mania. While fact-checking the speculative bubble of the 17th century, I realised that in 2007 a book was published by an American historian, Anne Goldgar, attempting to somewhat revise the earlier representation of that historic period popularised by Charles Mackay with his book from 1841. One of Goldgar's points is that the Tulip bubble was a much more confined event than originally presented by Mackay, with a...