AWARENESS BLOG

The purpose of these short blog articles is to increase awareness of one’s own perceptions in different finance-related contexts. Nothing in this blog or website represents an advertisement, advice, a recommendation, request, offer or invitation for an offer to buy or sell products.

Exponential growth, psychological biases and optimism

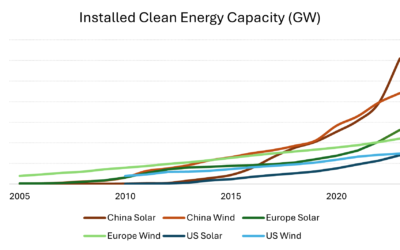

How fast is the energy transition progressing? Exponentially. And this despite the complaints about its slow pace from various sources[1]. Let’s consider different drivers supporting an optimistic view of the transition. Growth and technological progress Solar has been leading the exponential path when it comes to technology, compared to wind. And country-wise, China, which is well known to be dominating the solar PV market, has been leading, with a rapid acceleration in the last couple...

Reviewing the Net-Zero Transition

Let us review humanity’s path towards climate neutrality and its economic consequences over the next decade. Climate and natural resources are intimately connected, and we generally agree that we need to do two things: use resources more intelligently and parsimoniously and at the same time produce energy with a significantly lower environmental impact (primarily through lower GHG emissions). The goals for 2030 and 2050 have broadly been defined and most large enterprises have pledged to...

Blockchain society: trustless, cryptographic, ledger-based

A fundamental proposition of the blockchain economy and Web 3.0, is to eliminate, as much as possible, the need to trust counterparties and intermediaries. Is it actually possible to eliminate the need for trust, in fact a fundamental mechanism in human interactions? How likely is it that this vision will materialise and who would benefit from such a vision? Key features of a new possible and hypothetical global digital economic system are Trustless consensus based on mathematical,...

Net-Zero vs. Net-Impact

Is a company with large CO2 emissions worse than a company with net-zero emissions? Not necessarily. “Net-Zero” vs. “Net-Impact” Net-zero means that one emits CO2, but an equal amount of CO2 is removed from the atmosphere. A typical example would be emitting CO2 from a factory while planting new trees that absorb it. Great. Now let us imagine that a company pollutes quite significantly by using fossil fuels in the manufacturing process. At the same time let us assume that the products it...

Will crypto really change our system?

Is the crypto transition dead or just temporarily taking a break? These are usually useful times to reflect with a long-term orientation. Apart from the widespread and not unreasonable idea that Bitcoin can be seen as a digital form of gold, a long-term storage of value thanks to its decreasing and capped supply, how about the other blockchains and tokens and their volatility? Can some tokens be considered an investment at all, and if so, closer to an early-stage business or an emerging...

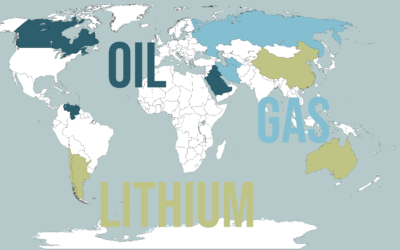

Batteries, metals and geopolitics

Should we expect in the coming years and decades conflicts and price shocks linked to battery materials just as the world has experienced with oil and gas in the last 50 years? Commodities of the past and future Two decades ago, when the first big wave of renewable energy investments started, many were imagining a world with solar panels and wind turbines powering a significant chunk of our economies. With one big bubble (bursting) in between, that scenario pretty much materialised. Europe...

Impact or fees?

What if instead of paying billions in fees that too rarely add value, investors only used passive listed equity funds, and the billions saved in fees were used for projects that have real impact on environment and society? Let’s look into some numbers. Value not added (on average) by the asset management industry The latest April 2022 study by ESMA (European Securities and Markets Authority) on performance and costs of UCITS funds estimates average ongoing costs (essentially TER) of 1.4% for...

Dining and investing – any difference?

You could say that when more restaurants pop up in a city, the easier it is, at some point, to find reasonably priced restaurants that offer good food and service - good on an absolute basis. The amount of competition does not reduce the chances that a new restaurant will deliver great food (on an absolute basis); quite the opposite. And that’s because in order to be competitive, you need a certain minimum level of quality. Similarly, the more investment professionals there are around who...

Economic Firefighting

We are experiencing the highest energy (power and gas) prices ever seen, supply chains are being disrupted worldwide, shortages of labour from drivers to waiters has been around for months. Can we consistently predict such dynamics? If not, how can we deal with such extreme but unexpected disruptions? This summer the implementation of a universal salary in countries like Italy led to a massive shortage of workforce, with some employers complaining that workers refuse seasonal opportunities,...

DEBIASING

One of the goals of financial (and more specifically investment) coaching is to implement a process of debiasing. Awareness is already an important step, but we generally need to do more effort and actively work cognitively to reduce our biases - I am not saying "eliminate" because of the somehow super-human magnitude of the challenge, but identifying and reducing them is already a major and important step. The DEBIASING newsletter does half of the job for you - it takes major investment...