Each fund manager a compelling story and a compelling experience, set of skills and/or track-record to boast. Some years or decades ago, hedge funds were the most popular ones deserving the highest fees, in the last years they have been in decline in terms of popularity, replaced by private equity, with its hefty management fees and carried interest (performance fees) calculated generally against a hurdle rate. Listed equity funds can command high fees, too, mostly relative to a fixed hurdle or an equity market benchmark.

But the point of this post is: how much carried interest/performance fees, in addition to management fees, is paid by the ultimate investors to the asset manager for a unit of net performance? how much of this is real value added and how much could be reasonablly replicated with other (cheap) instruments?

Some academic research

A paper by University of Oxford’s Ludovic Phalippou tried to estimate how much carried interest has been paid to PE managers from 2006 to 2019 (vintage years 2006-2015). His estimate is in the region north of 200bn (yes, over two-hundred billion) dollars … but wait, here comes the interesting part: with performance, he argues, comparable to listed equities. Now, small cap stocks are a reasonable benchmark for a PE fund, and it makes sense to use small caps instead of large caps; I would not take the T. Rowe Price small cap stocks fund as a benchmark, as it has a history of outperformance vs. its own benchmark, but even if we take an average performance that aligns with small cap equity beta, PE performance looks less stellar than myth suggests. Especially when we take the lock-up/illiquidity into consideration, and the limited diversification offered by a single vehicle.

Another paper by Harvard economist Josh Lerner et al., 2020, goes into more detail with regards to the dispersion of performance, focusing on certain sub-categories of PE vehicle. It shows that yes, the average return of the vehicles considered is in line with the public market (Russell 3000 benchmark), but also that 1) the large differences within the sample and 2) the fact that investors with better past performance tend to show better future performance, suggest different access to vehicles by different investor classes. Endowments, pensions and insurances are identified by the authors as potentially the best positioned to consistently enjoy the top performers, while the other investors (the authors mention explicitly funds of funds), have access to the poorer performers. And the poorer performers do not appear to be systematically and significantly cheaper in terms of fee structures.

While as usual, all research and analysis should be taken with due care, one should ask a few questions.

The questions

One question is: as an investor, am I realistically positioned to access the best performing PE funds or am I most likely destined to access the too expensive underperformers, and pay mostly for the “compelling story” and “appeal” of PE as a whole?

Another question is: if a liquid, low-cost investment, like a small cap ETF/fund is expected to deliver comparable returns as an illiquid, high-fees PE fund, does it still make sense to have PE exposure? There are arguments in favour and arguments against, general ones as well as specific ones to analyse on a case by case basis.

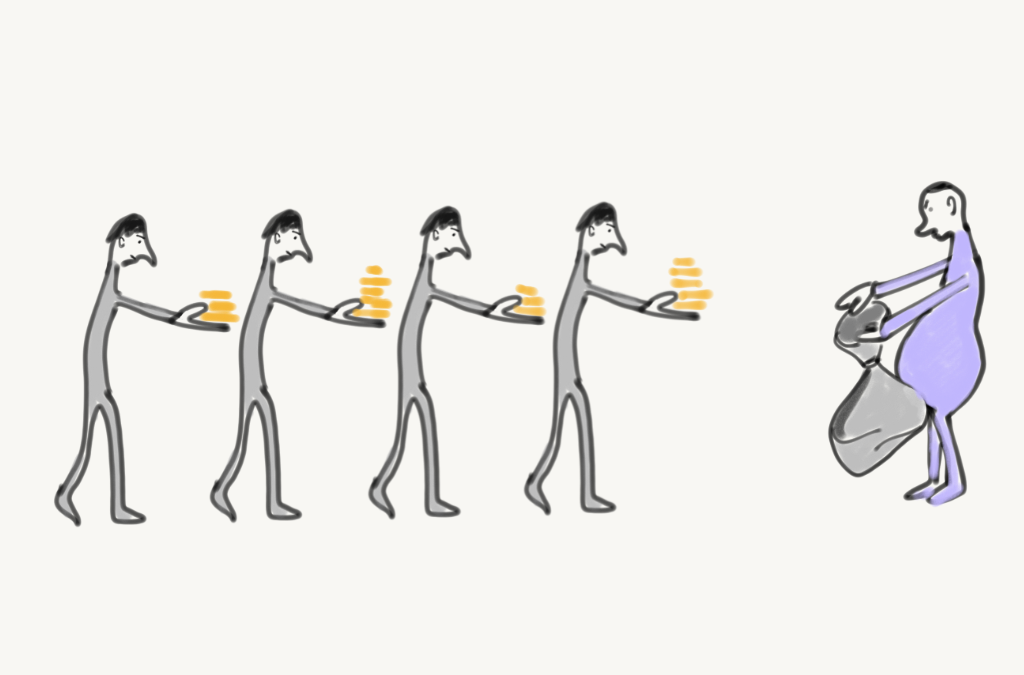

But for a comparable net performance, does it make sense to pay such high fees to a manager? As a matter of fairness, is the system designed to enrich a few who actually deliver performance that can be systematically (and not by pure luck or coincidence) replicated? The paper by Phalippou has some other interesting statistics on the redistribution of wealth, worth reading.

Papers mentioned:

Phalippou, Ludovic, An Inconvenient Fact: Private Equity Returns & The Billionaire Factory (June 10, 2020). University of Oxford, Said Business School, Working Paper, Available at SSRN: https://ssrn.com/abstract=3623820 or http://dx.doi.org/10.2139/ssrn.3623820

Lerner, Josh and Mao, Jason and Schoar, Antoinette and Zhang, Nan R., Investing Outside the Box: Evidence from Alternative Vehicles in Private Equity (May 5, 2020). Harvard Business School Entrepreneurial Management Working Paper No. 19-012, Harvard Business School Finance Working Paper No. 19-012, Available at SSRN: https://ssrn.com/abstract=3230145 or http://dx.doi.org/10.2139/ssrn.3230145