Heating and cooling are the largest element of GHG emissions in buildings and building insulation is a major tool to reduce energy consumption and emissions at a local and global level. Europe introduced the Energy Performance of Buildings Directive (EPBD) already in 2010 and the Energy Efficiency Directive in 2012. The directives were revised in 2018 and 2019 as part of the Clean energy for all Europeans package and in 2020 the European Commission presented a strategy to renovate private and public buildings as part of the so-called European Green Deal.

The focus of this analysis is on thermal insulation.

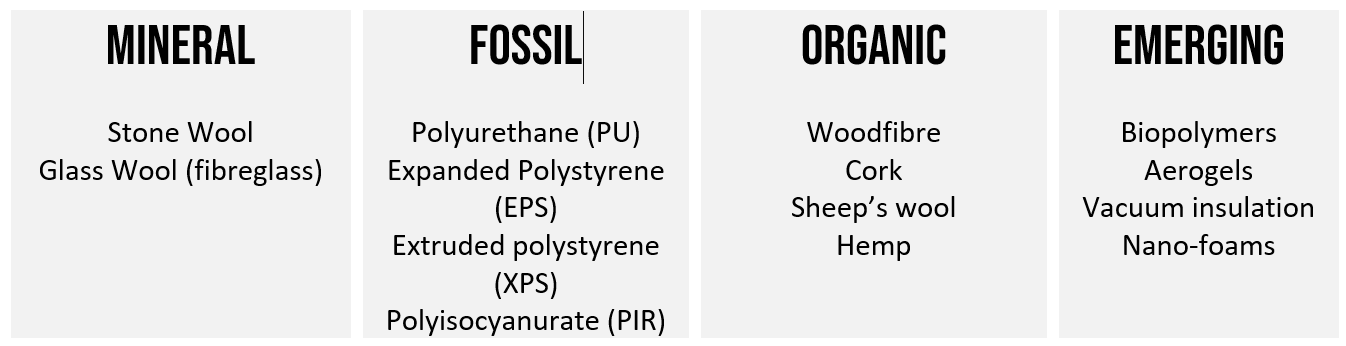

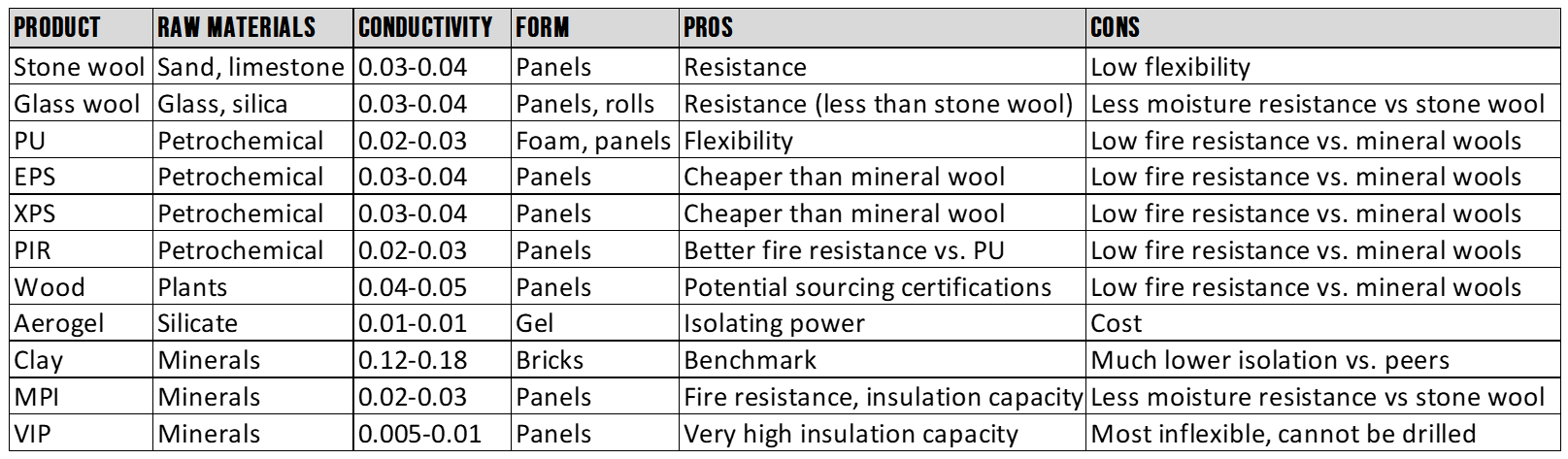

Each product has technical advantages and disadvantages, like the trade-off between insulation capacity and thickness, varying costs and different environmental impacts. Mineral wools dominate the market, followed by EPS and XPS and then PUR and PIR. The table below summarises the main properties of each material category.

Business model

The high-level business model for thermal insulation materials is to engineer and industrially manufacture the insulating panels, whereby different product categories have varying insulation properties, costs and properties such as thickness (for a given thermal insulation capacity). Certain products have a higher technological, R&D component, than others, think of aerogels vs. sheep wool – each with its own attractivity.

The manufacturing process is energy-intensive and it is essential for the insulating materials to save over their lifetime much more energy than the energy needed to manufacture them. Sustainability in the value chain plays an important role, especially in terms of energy security and pricing. Not something we can give for granted, as we have all recognised in 2022.

Apart from the technological aspects, the distribution channels play a key role in the success of a company, with products marketed to distributors and ultimately to end users.

Competitive position

The industry has a decent competitive position, especially at the top, as some of the largest players have a dominant position in their own product areas (e.g. mineral wool).

SubstitutesThe threat of substitutes is limited as new technologies need time to scale up production and significant breakthroughs would be needed to achieve superiority. That said, environmental regulations can play a role. |

new entrantsApart from the technology/IP, new entrants face difficulties in entering the distribution channels dominated by large players. |

buyer bargaining powerBecause of competing technologies and multiple manufacturers, buyers have bargaining power. Construction subcontractors are particularly pressured on margins and have strong incentives to bargain. |

supplier bargaining powerLimited due to relatively commoditised input products. IP resides principally with the manufacturer itself. |

competitive rivalryWhile there are many companies in the space, the largest players have a strong position, which limits competitive rivalry at the top. Large players have historically engaged in M&A activity consolidating the market. |

|

Demand drivers

ConstructionNatural demand for insulation materials comes from the normal course of building and renovating. The construction sector is cyclical hence demand for insulation materials is also cyclical. |

energy efficiencyEnergy efficiency plays a key role, in particular the European targets for energy efficient buildings and the national incentive schemes. Homeowners and landlords can be either forced (by regulation) or incentivised (by governments) to renovate. |

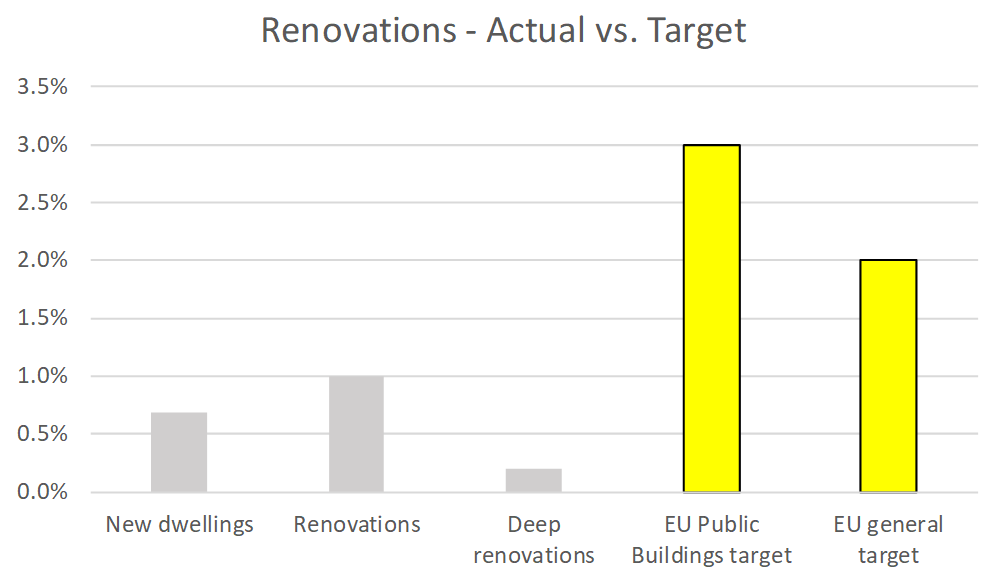

To put things into perspective, European targets for energy-efficient buildings are quite ambitious compared to current renovation rates, so in order to achieve the stated targets, we should expect significantly higher renovation rates compared to history.

These ambitious targets are the more challenging when the overall economic situation is characterised by slower growth and tighter financial conditions. The cyclicality of the real estate market plays an important role and slowdowns in economic activity need to be balanced by incentives and/or regulations if the EU’s targets are to be achieved.

Supply dynamics

Increases in supply require the construction of new manufacturing plants and the availability of relatively abundant or cheap raw materials and energy. The current (Oct ’22) situation is not supportive for new investments in manufacturing capacity, due to higher (and potentially rising) interest rates, significant economic uncertainty and high raw material and energy prices. Of course, things can change very rapidly.

Significantly higher renovation rates as those targeted by the EU, can become challenging for insulation material suppliers in terms of production capacity. Whether the higher renovation rates will materialise to 2030 and supply will be elastic enough to accommodate for it without creating shortages or price spikes, remain the two key factors determining the success of the sector.