The China crackdown on cryptocurrencies, ranging from mining to trading, from payments to investment products, covering most of the value chain, was seen in the West (at least this is my impression) mostly as a speculative headline. Just to cite two sources see this summary by Reuters and another article by the South China Morning Post.

What I find interesting is that while China may have taken a somewhat aggressive and cohercive stance, it at least seems to have sent a strong message to people also about the risks of highly speculative activitiy. In the context of more or less obvious strategic, power and control reasons, they are saying that not only crypto mining is kind of bad for the environment and can have negative consequences for parts of the system, but also that the speculative part is “bad”.

What are we focusing on?

What we have been focusing on here in the West, especially lately, is mostly how non-ESG bitcoin mining is. In the media voices resonate who say that one of the most industrial/entrepreneurial parts of the crypto value chain, the blockchain itself, is bad for energy and climate reasons – which may be fair enough, although it is a complex issue and there would be solutions. While I am absolutely not a fan of overregulation, bans on innovation etc., find it awkward that so much emphasis is put on the environmental issues of bitcoin mining, and comparatively little on educating people about the risks of pure speculation. In the last days we have already seen large corrections in token prices. These are still far lower than the total drawdowns seen in 2018. Trading in general has been very volatile, with the crypto market strongly up overall at the time of writing. There is no crystal ball, but have people been focusing on only one aspect (the mining-environment conflict), neglecting the big picture of risks?

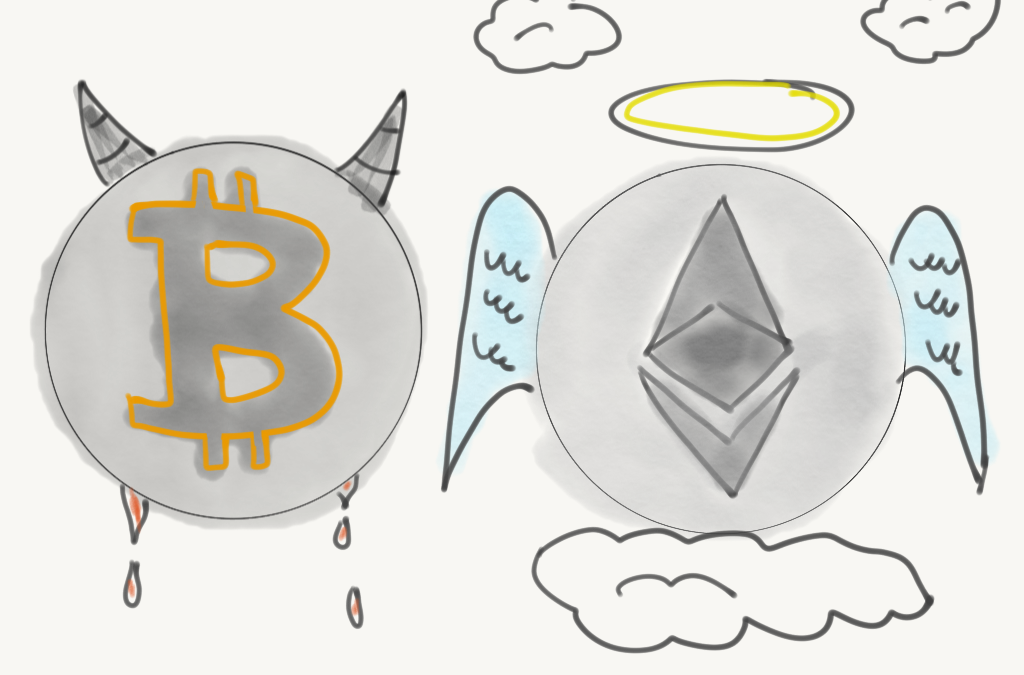

Note: the drawing above is not a parody of the current spread in energy consumption between Ether and Bitcoin, rather of the expected energy savings from the planned transition to proof-of-stake.