AWARENESS BLOG

The purpose of these short blog articles is to increase awareness of one’s own perceptions in different finance-related contexts. Nothing in this blog or website represents an advertisement, advice, a recommendation, request, offer or invitation for an offer to buy or sell products.

The more unprofitable, the better?

For a while I have been intrigued by the prominent money-losing (in terms of earnings) IPOs in the last few years, from cannabis stocks to cloud and big data, that have been welcomed by such high levels of interest. Why are money-losing businesses so attractive? Well, mostly because there is a good, attractive and convincing story behind them. Almost two years ago, an FT articles was already referring to a very interesting time series by Mr. Jay R. Ritter from the University of Florida, who...

Crypto Staking, a new way of chasing yield?

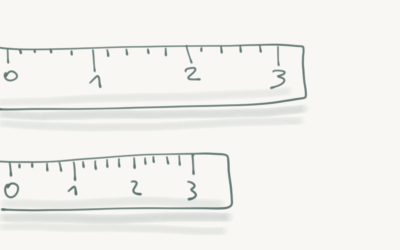

The Ethereum blockchain is planning to move from a so-called proof-of-work validation approach, to a proof-of-stake, where validators put their cryptocurrency at stake instead of mining to validate a block. Crypto exchanges offer programs where you can earn rewards from staking your balances. How strong a driver of purchaes and price the search for staking yield is, is hard to say. But I was curious to see how staking yields compare to more traditional asset classes in terms of risk &...

Sustainable investing … really?

We want to invest sustainably, we want to show we are good people. Buying a sustainable fund is a great way to show that we are good people, isn›t it? Let us have a look at 3 alternatives (one ETF and two funds) for the Swiss market. I am not recommending anything here, it is just about objective reflection. Let me first take the UBS SPI ETF, with a total expense ratio of 0.16% per year. This would be a non-(explicitly)-sustainable investment alternative, see holdings below (only showing the...

Peak Oil… no, actually… or Peak Copper?

Roughly 15 years ago I was still a student and was sitting in the audience of a broker presentation on oil stocks, a hot topic at the time. When the Q&A time arrived, I asked the analyst there what he thought about Peak Oil theory. At the time, it was spreading and becoming an increasingly popular theory. The theory was predicting that the world was going through a shortage of oil production, potentially leading to sky-rocketing oil prices. The market seemed to confirm this until 2008....

Of mice and men

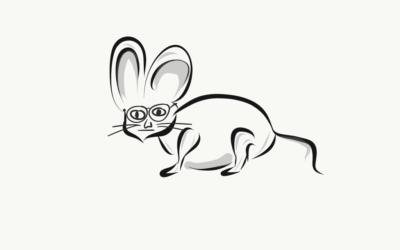

There has been quite a lot of exciting (for me, at least) neurological research in the last few decades aimed at understanding the neurology of risk taking, with research on our dear laboratory rats, testing for example how their behaviour changed when injecting amphetamine, nicotine and diazepam into them (Mitchell et al, 2011), until more recent studies on “laboratory humans”, a.k.a. university students (Burke et al, 2018), testing the effect of anti-schizophrenia medication called...

Advice vs. Coaching in Finance

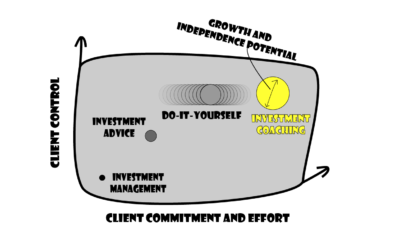

The financial industry, specifically its investment management branch, has traditionally operated based on 3 models: investment management, where a client appoints one or more managers to invest and divest, buy and sell securities on his behalf; investment advisory, where a client appoints one or more advisors (specialised advisors or his bank’s wealth management division) to provide him with recommendations on which products (stocks, funds, bonds, ...) to buy, how much to invest in different...

Mentor or Coach?

In the last couple of years “coaching” has become more popular, although some confusion on the meaning remains, and the subtle as well as not-so-subtle differences between coaching and mentoring, and between coaching/mentoring and educating, is not always appreciated. Mentoring should be understood as a rather long-term and broad relationship between the two individuals (mentor on one side, client/colleague on the other), aimed at fostering the development of the client in a broader sense....

Financial Planning and Cost Optimisation

I would argue that financial planning, be it conscious or unconscious, controlled or uncontrolled, starts around primary or latest secondary school, when your future academic and career paths already start to be defined and will potentially be compounded over decades. In any case, it is important to ask yourself certain questions about your desired (and realistic) standard of living, career, family plans, etc. and ideally formalise a financial plan that you can use for future guidance. Are you...

Brain, Performance, Objectivity

Bad investment performance? Why is that: many bad decisions? Or just one or two bad ones? Solid but unlucky decisions? And is it with respect to instruments selected? Or sector choices? Or maybe even at an asset class level? And that good investment manager you chose...why did he perform so well? Very good at picking stocks or made a big bold bet on styles knowing that “head we all win, tail only you lose”? If you are not yet asking yourself these questions, it may be worth starting to, to...

Investment Decisions and the Investment Process

An investment process, be it formalised or informal, be it in the context of an asset manager or an individual investor, encompasses all information, actions and decisions from data gathering through analysis down to actual investment decisions and even further, with decision and performance analysis (detailed in a separate section). The key point is that there are naturally multiple decisions and biases through the whole investment value chain that may not be compared to a butterfly effect,...