We want to invest sustainably, we want to show we are good people. Buying a sustainable fund is a great way to show that we are good people, isn›t it? Let us have a look at 3 alternatives (one ETF and two funds) for the Swiss market. I am not recommending anything here, it is just about objective reflection.

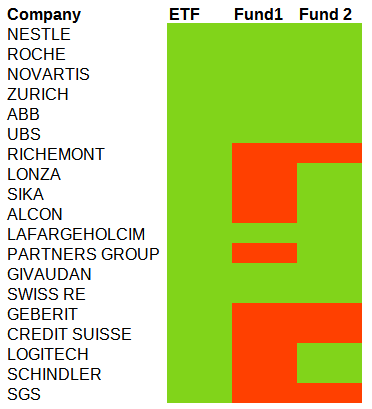

Let me first take the UBS SPI ETF, with a total expense ratio of 0.16% per year. This would be a non-(explicitly)-sustainable investment alternative, see holdings below (only showing the largest adding up to 80% as of the latest publish annual report (30th June, 2020) – not much difference if you take the latest weights (May 6th, 2021 at the time of writing). Do these stocks sound particularly sustainable? Or particularly unsustainable? You decide.

Now look at the table again. I am comparing the holdings of the UBS ETF with those published in the latest annual/semi-annual reports of two «Swiss Sustainable» funds, one by UBS and one by Vontobel (31st October, 2020 resp. 31st August, 2020). The Factsheets only show the top 10 positions, so using the annual/semi-annual reports to have more holdings despite the time delay and some inconsistency in the exact dates, but this does not change the big picture (the only note I have to make is that the Vontobel fund weightings of the top 3 holdings changed significantly to strong underweight vs. benchmark SPI, but this does not have an impact on the point I am trying to make).

The UBS fund (Fund 1) shows some significant differences in the top holdings, whereas the Vontobel fund is closer to the ETF. If you calculate the active share, the differentiation vs. the benchmark, based on these snapshots, you get to the 10-20% range, with Fund 1 somewhat higher than Fund 2. Even Fund 2 is not at closet benchmarking levels, but definitely not high. Note that the two funds charge TER of 0.60% in the case of UBS (class Q), and 0.84% Vontobel (class AN), the retail, retrocession-free share classes. Both funds have underperformed the SPI benchmark by ca. 0.50% p.a. over the past 5 years, while the ETF has underperformed by ca 0.13% p.a. – so roughly all in line with the TER.

I am not blaming the managers, you could argue that maybe there is not much you should disregard as «unsustainable» according to the criteria so you can›t be soooooo active, but one should ask himself:

- is such a «sustainable» fund what you would understand as «sustainable» compared to an index ETF?

- does it make sense to pay 0.4-0.7% p.a. more for this kind of screening and slightly active allocation?

- do you feel you are a doing good to the world by investing in such a sustainable fund?

- In the end, who is really profiting?