Roughly 15 years ago I was still a student and was sitting in the audience of a broker presentation on oil stocks, a hot topic at the time. When the Q&A time arrived, I asked the analyst there what he thought about Peak Oil theory. At the time, it was spreading and becoming an increasingly popular theory. The theory was predicting that the world was going through a shortage of oil production, potentially leading to sky-rocketing oil prices. The market seemed to confirm this until 2008. Then oil collapsed, recovered, was volatilte, and you could not hear so much about Peak Oil theory anymore. Until more recently, when instead of Peak Production, the media as well as the oil companies started talking (see BP analysis1 below) about Peak demand. Quite a big U-turn! And in the last months and especially now with copper prices rallying strongly, we hear about … Peak Copper (production).

It is always good to keep a healthy skepticism towards popular theories. In 2010, a paper by researchers at the University of Oxford2, concluded that all-in-all, 2015 was a reasonable horizon to expect peak oil production relative to demand and you can find loads of authoritative voices claiming such scenarios. Based on British Petroleum’s annual statistical review3, global oil reserves went from 1.3tn barrels in 2009 to 1.7tn barrels in 2019, while production rose from 82 to 95m barrels per day, after a brief and minor pause between 2007 (83m) and 2009.

Now, are prices going up because of these theories, and is the popularity (in the media) of these theories, a refelction of their validity?

Or are theories produced and pushed through the media in order to justify price moves?

A combination of both, in a feedback loop that is a driving force behing the production of market trends.

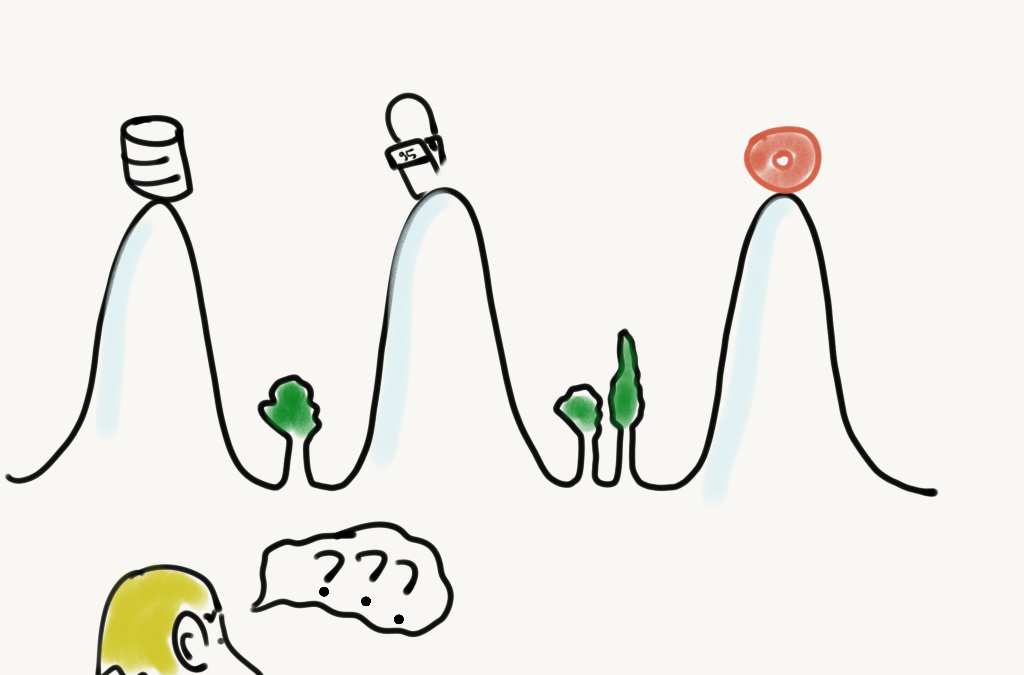

The problem is, if you get into it at the end of the trend, once the «Theory» has reached every single person, from the geologist to the analyst, up to our grandmothers, then the risk/reward is not so attractive anymore as it is very likely that most who could be long, are already long (oil, copper, or whatever commodity).

Where are we in terms of «theory penetration» withtin the financial and non-financial/retail community, with regards to peak oil demand and peak copper production?

And how does this affect the risk/return of each commodity investment?

Bibliography:

2https://www.sciencedirect.com/science/article/abs/pii/S0301421510001072?via%3Dihub

3https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html