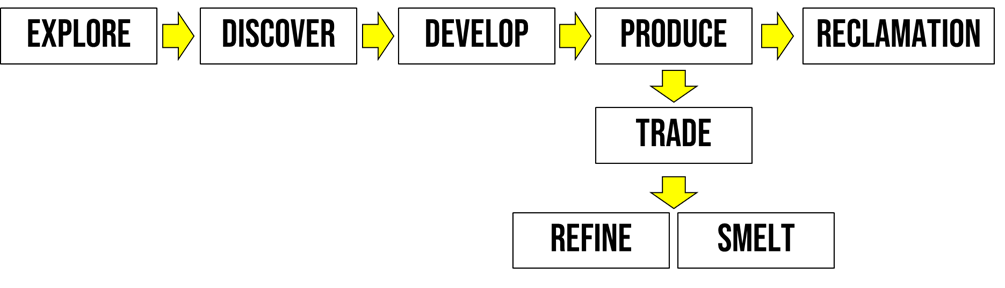

The mining business is a complex one in terms of technology, logistics, environmental management and regulatory constraints and risks. Also, the decision to start a mine has a very long-term horizon, as several years (indicatively 5-10) are required to start operations and the life of a mine can cover multiple decades.

The main risks faced by miners include

- Prices that are lower than expected or planned when the decision to launch a project was taken, e.g. due to increased supply and/or lower demand for a metal;

- Legal risks with respect to royalties, taxation, land reclamation and community relationships;

- Legal risks with respect to political instability and sanctions;

- Legal risks with respect to environmental requirements.

These risks can on the other side be a factor of success for miners who have a strong marketing capability and financial discipline, who have resources in countries with relatively low regulatory risks, and operate in an ESG-conscious way.

Investment questions

Key questions for investors in mining equities are the following:

|

How much will demand for certain metals grow and how large is the uncertainty in such demand scenarios

|

Can technological advances radically change the demand dynamics, e.g. due to substitution of certain metals

|

|

What is the downside resp. upside for metals prices from the current market situation

|

What are key risks that could affect demand resp. supply, both negatively and positively

|

These questions will be addressed in the following sections.

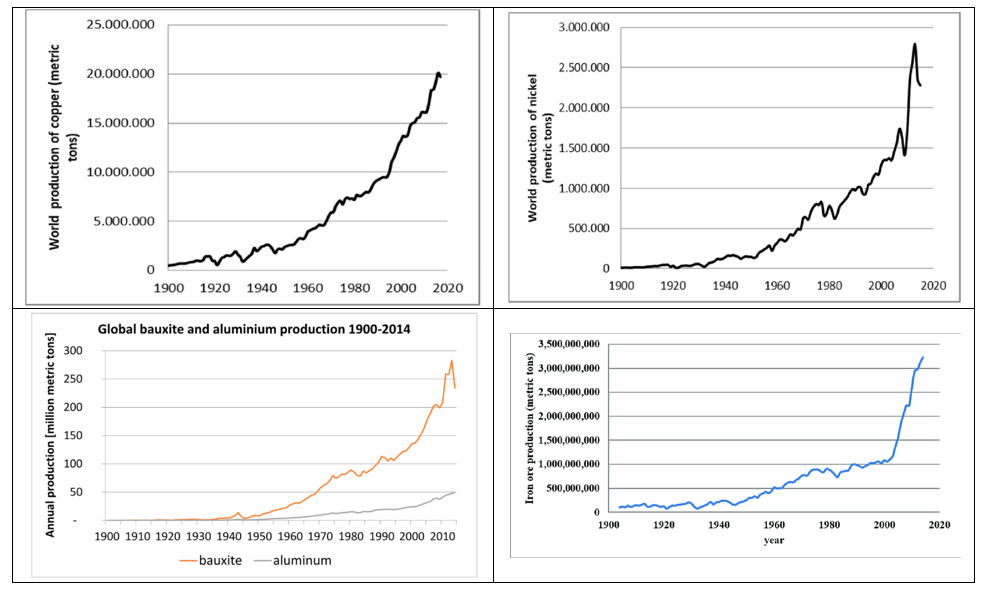

Historical demand and supply

The demand for industrial commodities is cyclical and dependent on the strength of the global economy. That said, historically we have experienced a very long-term trend of increasing consumption and production, see the charts below compiled from the US Geological Service data. We see that despite strong volatility in certain periods, demand for key raw materials does not easily disappear.

Variations in demand and supply are the main drivers of changes in prices, as we have cycles and so-called super-cycles that last ca. 30 years. According to research and methodology by the Bank of Canada, we had 4 broad commodity supercycles in the last 100 years: 1899-1932 (peaking in 1904), 1933-1961 (peaking in 1947), 1962-1995 (peaking in 1978) and the last identified cycle starting in 1996 and peaking in 2011. It is still too early to conclude whether in 2022 we are still in the cycle starting in 1996 or whether we already started a new one in 2020 as commodities bottomed during the covid pandemic.

It should be noted that different commodity groups can and do have different super-cycle patterns.

The main industrial metals that are relevant for the next decades include standard ones like iron ore and less common ones like cobalt and lithium. The environmental goals of the Paris Agreement and the urgent need to improve our world’s air quality require these metals unless extremely cost-efficient solution for carbon-capture are developed and very rapidly implemented all around the world. Key energy-transition applications in the table below based on research by Henckens (2022).

metal |

Major applications |

|

Steel (iron ore) |

Wind turbines (structure) |

|

Copper |

Widest range of applications |

|

Aluminum (bauxite) |

Wind turbines, solar pv, networks |

|

Nickel |

Battery Electric vehicles |

|

Zinc |

Wind turbines (corrosion protection) |

|

Cobalt |

Battery electric vehicles |

|

Lithium |

Battery electric vehicles |

Other metals will also play an important role, like those commonly categorised as “rare earths”, such as neodymium, used in magnets for wind turbines, and tellurium, used in solar cells.

Demand forecasts

metal |

DEMAND forecasts |

|

Iron ore |

Moderate |

|

Copper |

Strong |

|

Aluminum (bauxite) |

Strong |

|

Nickel |

Strong |

|

Zinc |

Moderate |

|

Cobalt |

Strong |

|

Lithium |

Very strong |

One of the metals with the strongest expected demand growth is Lithium, which is a key ingredient as we know for batteries. The increased need for EV batteries requires a massive growth in Lithium production compared to current levels unless other alternative technologies are used. Excessively high prices for Lithium, in case of insufficient production, may make alternative technologies (e.g. hydrogen fuel cells) more attractive.

Indications above in line with data from the Minerals Council of Australia and research by Watari et al. (2020).

Metals Geopolitics

Natural resources are strongly influenced by geopolitical factors as countries controlling natural resources can impose limits on exports and weaponize them against hostile countries or use them as a bargaining chip for negotiations in general.

metal |

Top producing countries |

||

|

Iron ore |

Australia |

Brazil |

China |

|

Copper |

Chile |

Peru |

China |

|

Bauxite |

Australia |

Guinea |

China |

|

Nickel |

Indonesia |

Philippines |

Russia |

|

Zinc |

China |

Peru |

Australia |

|

Cobalt |

DR of Congo |

Russia |

Australia |

|

Lithium |

Australia |

Chile |

China |

Among developed economies, Australia plays a fundamental role in supplying key energy transition metals to the world. China has a strong position in many essential metals. It is weaker in Nickel but could be supplied by its ally Russia. Chile plays a fundamental role due to its strength in both copper and lithium.

Geopolitical considerations may have an impact on the future of certain applications. Supply security could gain weight as an important factor for public policies incentivising or disincentivising specific technologies. From that perspective, cobalt is the metal most at risk in terms of supply security as its production is most heavily concentrated in one, unstable country, and the second largest producer is Russia.