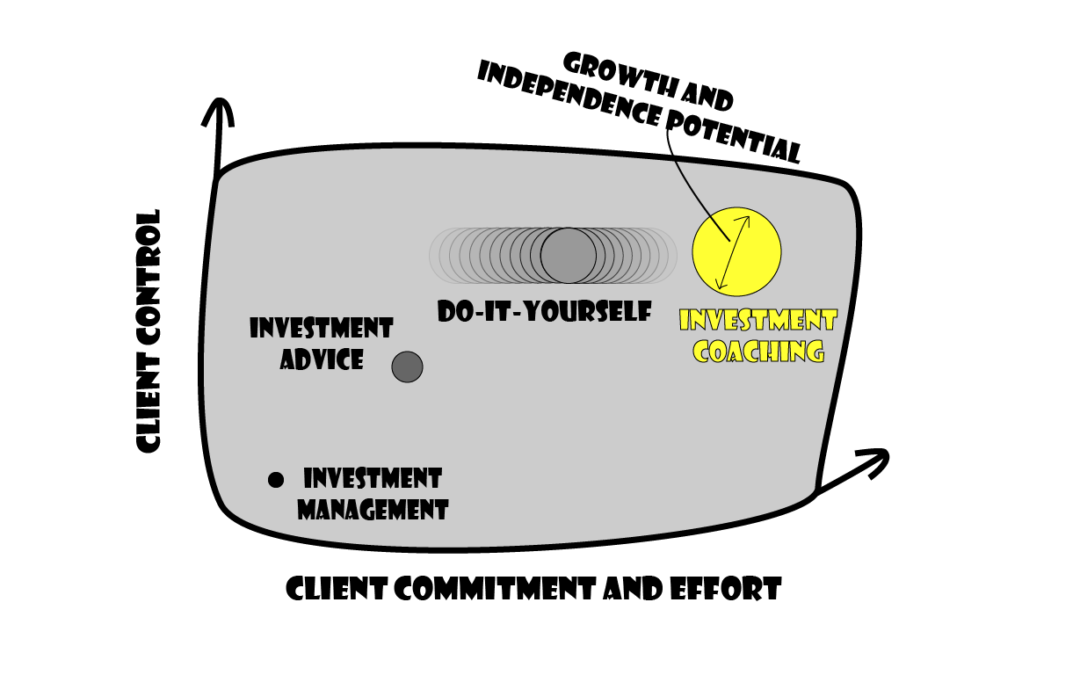

The financial industry, specifically its investment management branch, has traditionally operated based on 3 models:

- investment management, where a client appoints one or more managers to invest and divest, buy and sell securities on his behalf;

- investment advisory, where a client appoints one or more advisors (specialised advisors or his bank’s wealth management division) to provide him with recommendations on which products (stocks, funds, bonds, …) to buy, how much to invest in different asset classes, etc. – the client takes the ultimate decision, but this is often influenced or even driven by the advice received;

- execution-only, where the clients autonomously decides what to buy and sell, how to invest and divest his own money.

What if you wanted to take (or keep) control over the investment decisions, while having a sparring partner who challenges your investment ideas, looks for the weaknesses in your investment thesis, in order to help you take more robust and better informed investment decisions? This is the coaching difference – it is not advice because coaching is not about making recommendations, rather about stimulating a client’s thinking and empowering him to make good decisions.