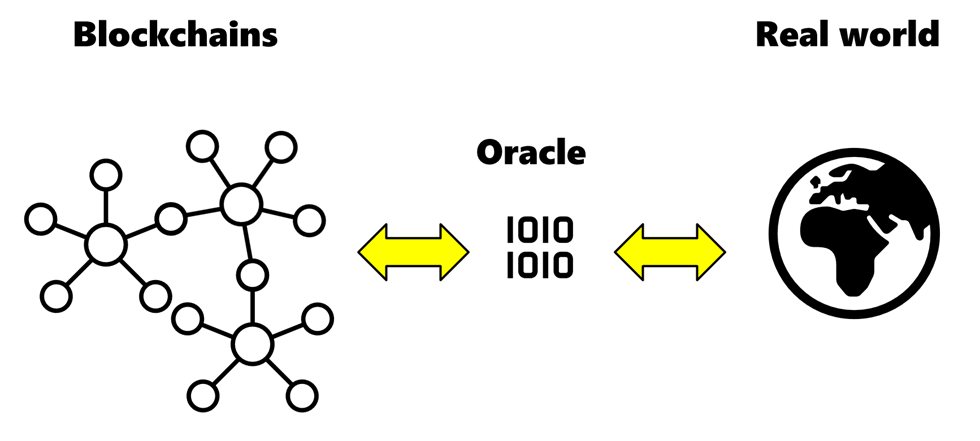

Introduction to Blockchain oracles

Blockchain oracles are systems that feed off-chain data to a smart contract and send smart-contract (output) data outside of the blockchain. Oracles are essential for real-world blockchain applications. Oracles are used currently mostly for DeFi applications that need market data, as well as random number generation, applied for example to online gaming.

One dual classification of Oracles is into centralised and decentralised oracles.

- Centralised oracles are essentially traditional data services where one provider supplies the data and users need to trust the quality of that data. This also creates a single point of failure in the system.

- Decentralised oracle networks are mechanisms that collect data from multiple sources and, based on specific algorithms and user parameters, pick the data that best fits those criteria (such as reputation in terms of data quality as well as cost).

Business model

The business model of decentralised oracles relies on creating a competitive market for data based on objective criteria therefore reducing the probability that data flowing into a smart contract cannot be trusted or is not available.

If we take the Chainlink example, oracle nodes provide the data for a certain price, while smart contracts pick what they need and pay for this service. The oracle protocol aggregates the data from various oracle nodes, weighs them, and provides the final answer (e.g. the median of all answers). The oracle nodes who provided solid answers are rewarded with tokens.

Today a financial intermediary would purchase data from Bloomberg or Reuters (centralised oracles) who in turn purchase data from other data providers upstream, like exchanges. With decentralised oracles, a financial intermediary operating through a smart contract would purchase data from multiple oracle nodes (not just Bloomberg, to pick one) who in turn purchase and control data from various sources (could be the exchanges, bypassing Bloomberg and Reuters, or could be Bloomberg, Reuters and more).

The value added is that there is no single point of failure anymore and there could be economies of scale by increasing competition among data providers and increasing purchasing power on the client side.

Oracle market structure

While there are many oracle protocols, the market currently is highly concentrated around Chainlink. At the time of writing, Chainlink reports over 1’800 integrations and research by Coin98Analytics places it by far at the top in terms of partnerships. According to DefiLlama data, excluding special cases Maker and WINkLink, Chainlink secures almost half (45%) of the market by value secured (that is, value locked in protocols relying on a certain oracle) in an otherwise highly fragmented market, followed by Band protocol at less than 2%. Most TVS for Chainlink comes from DeFi protocols Aave and Compound. Below a list of decentralised oracles integrated in the major Blockchains.

Oracle |

Token |

Ethereum |

Polygon |

Avalanche |

Solana |

|

Band |

X |

X |

X |

X |

X |

|

Chainlink |

X |

X |

X |

X |

X |

|

DIA |

X |

X |

(X) |

X |

X |

|

Dos.Network |

X |

X |

|

|

– |

|

Nest |

X |

– |

– |

– |

– |

|

Paralink |

X |

X |

(Announced) |

– |

– |

|

Provable |

– |

X |

– |

– |

– |

|

Pyth |

(Planned) |

– |

– |

– |

X |

|

Razor |

X |

– |

X |

– |

– |

|

Switchboard |

– |

– |

– |

– |

X |

|

Tellor |

X |

X |

X |

– |

– |

|

UMA |

X |

X |

X |

– |

– |

|

Umbrella |

X |

(X) |

(X) |

(X) |

(X) |

|

Witnet |

X |

X |

X |

X |

– |

While several oracle networks have been developed, quality and security remain distinguishing factors defining the market’s structure. An example is the Umbrella oracle network, a recent player who quickly integrated with some of the major Layer 1 and 2 blockchains, but was exploited by hackers in May 2022 and led to a setback in the further development and usage of the protocol.

Competitive position

Decentralised oracles can see competition within their category especially if they do not have an ecosystem,

upstream, that is difficult to replicate. Hard replicability may arise because

- Node operators have switching costs (system adaptation, code, administrative inertia);

- Large oracle networks have a cost advantage by aggregating demand and supply;

- Large oracle networks have a data (quantity and quality) advantage thanks to the amount of data sources and resources invested in guaranteeing high-quality data.

The interface between smart contracts and oracles appears less of a barrier to entry. Decentralised oracles compete with centralised oracles. While decentralised, trustless oracles provide value in terms of robustness, the question becomes which solution is least expensive given an acceptable quality of the data.

We can imagine a future scenario where we have a concentrated decentralised (meaning few protocols with many oracle nodes) and a relatively concentrated centralised oracle market, due to economies of scale. But we could also imagine differentiated offers, where we have a range of oracle networks with different prices and functionalities. We need to maintain an open mindset.

To put things into perspective, Bloomberg has revenues of ca. $12bn, smaller competitor Factset less than $2bn, while the financial market data market is estimated at over $35bn. We see a significant concentration at the very top.

The competitive positions of incumbent centralised data aggregators might weaken due to likely more concentration (and therefore bargaining power) on the customer side. Instead of having thousands of financial service providers buying financial data, we may end up with just dozens of node operators who collect and verify such data.

Risks AND Potential

Decentralised oracles are not strictly necessary in a blockchain design. Centralised oracles could be used, and the market could be served by traditional data providers. The key question is whether decentralised oracles will become an established standard and the market or regulators will see value in data decentralisation, mostly because of robust designs. The market is still in its early stages of development. In the medium term we can expect demand for decentralised oracles to rise significantly, as more dApps are being developed and explore the functionality of decentralised oracles. A very large uncertainty exists with respect to decentralised oracle demand in the long term.

In a world where important economic transactions are processed by smart contracts, the idea of a decentralised oracle network that provides more statistical certainty (or rather quantifies statistical uncertainty) without relying on a single point of failure, is a valuable proposition.

Another large degree of uncertainty concerns who will be the leading players in the space – a detailed analysis of individual oracle providers is beyond the scope of this document. Rapid technological advances and evolving standards can radically reshuffle the rankings of the most widely adopted and valuable solutions.

Price volatility also plays an important role in the viability of an oracle business model – while it can be argued that higher token prices may reflect the value of the information, large volatility is generally problematic for businesses that value stable cash flows. Volatility may be interesting (and also dangerous, of course) in the short term for speculators. It may be highly problematic for the decentralised oracle business model in the future, unless there is a change of mindset whereby information is seen as electricity – highly volatile and strongly dependent on short-term supply and demand imbalances.